Freeport

What is Freeport

Freeports are special areas within the UK’s borders where different economic regulations apply. By delivering investment on specific sites benefitting from tax and customs incentives, freeports could create thousands of high-quality jobs in some of our most disadvantaged communities.

UK Freeports are special economic 45km zones, within the UK’s borders, centred around one or more air, rail, or seaport, where different economic regulations apply. UK Freeports will play a crucial part in the UK’s post COVID-19 recovery, helping to build back better, driving clean growth and contributing to the ‘levelling up’ agenda.

By delivering investment on specific sites benefitting from tax and customs incentives, freeports could create thousands of high-quality jobs in some of our most disadvantaged communities. These sites have been carefully selected for their suitability for development by local authorities and key private partners and sit within an outer boundary, which represents the geographical location within which the benefits of freeports are targeted and does not in itself confer any special tax, customs or other status.

At its core, the UK Freeport model has three key objectives:

- Establish UK Freeports as national hubs for global trade and investment

- Create hotbeds for innovation and net zero initiatives with private and public sector investment in R&D

- Promote regeneration and the creation of high-skilled jobs.

The LCR Freeport

Liverpool City Region (LCR) Freeport is one of only eight freeports in England. After working in partnership with ports, businesses, local authorities, trade unions and wider stakeholders, its Full Business Case (FBC) was approved by the UK Government in December 2022.

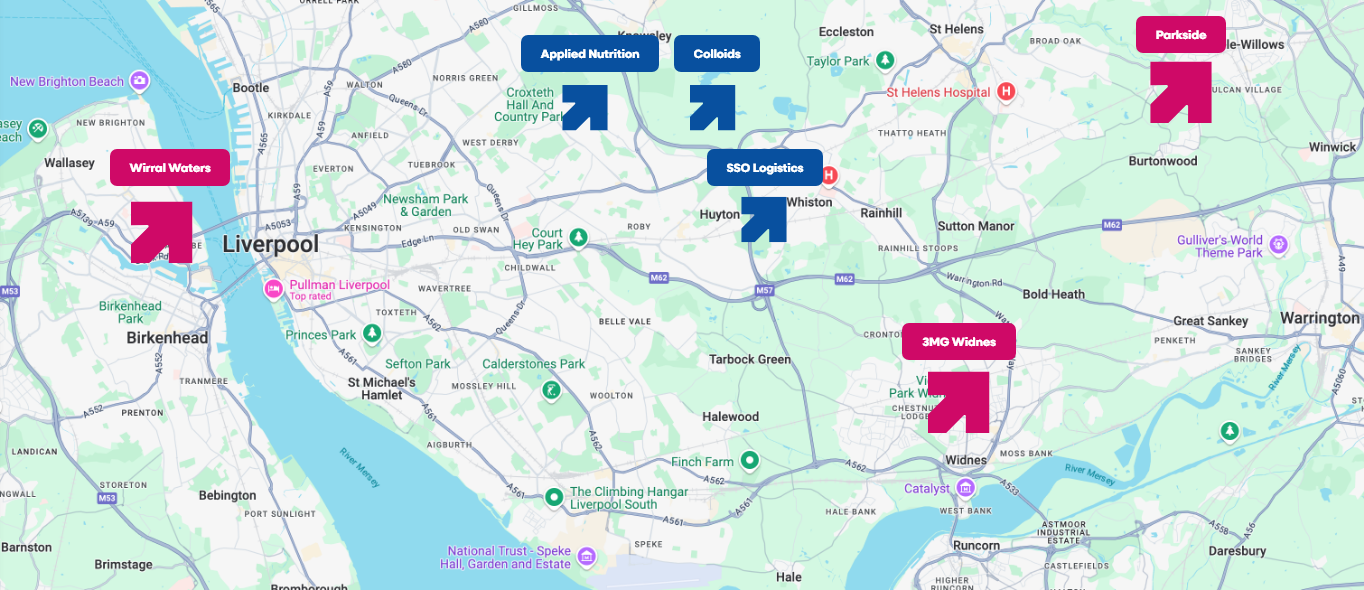

The Liverpool City Region, home to the country’s leading transatlantic port, is a natural freeport location. With the UK’s biggest western facing port, handling 45% of the UK’s trade from the United States, the Freeport area takes in a 45km diameter from the western point of Wirral Waters to the eastern point of Port Salford and includes all six of the city region’s local authorities.

Designated areas within the freeport zone will benefit from incentives to encourage economic activity. Freeports operate with both ‘tax’ and ‘customs’ sites. Tax sites offer occupiers business rates relief and other incentives to support capital investment, skills and employment. Business rates generated at the tax sites will be retained locally for 25 years and reinvested in the area. Customs sites help enable the tariff-free movement of goods for both export and import through simplified customs procedures.

The LCR Freeport is a multi-gateway, multi-modal zone covering 300 hectares of land and the freeport sites, which include several existing rail terminals and water-accessible locations, are located within areas of logistics and manufacturing capability.

The freeport has been shaped to support the delivery of the Liverpool City Region’s vision outlined in its Plan for Prosperity and Economic Recovery Plan.

Its overarching aim will be to ensure that the freeport contributes to the city region’s ambitions to create a fairer, stronger, cleaner city region, where no-one is left behind.

The positive impact of LCR Freeport is

expected to be significant, including:

310ha land for development

£800m GBP of total investment

14,000 gross direct and indirect jobs created

675,000sqm of commercial floorspace created

£850m GVA

£1.5m GBP towards Skills, Innovation and NetZero initiatives

The LCR Freeport is operated under strict governance set out in the FBC, in the interest of all six local authorities and Liverpool City Region Combined Authority. The LCR Freeport Management Board meets quarterly and the Freeport Delivery Groups meet regularly.

Tax sites

Tax sites provide a range of benefits and are designed to attract new business operations and generate additional, added value investment. LCR Freeport’s designated tax sites are:

Parkside, St Helens: the largest strategic employment site in the City Region, it is located in St Helens close to the M6 and M62. The site includes the former Parkside Colliery and hopes to attract advanced manufacturing and logistics businesses.

3MG, Widnes: offers direct connections to the UK motorway network and rail access from the West Coast Main Line. 3MG is already involved in the hydrogen economy supporting capital investment in low carbon fuels and infrastructure.

Wirral Waters: located around the Birkenhead Docks, it has port connectivity, direct access to the M53 motorway and is located within the Mersey Waters Enterprise Zone.

It comprises significant areas of dockside land capable of attracting a range of port-centric businesses, advanced manufacturing, innovation and research and development activities. Eligible businesses in freeport tax sites will enjoy a range of tax incentives:

- Stamp Duty Land Tax relief

- Enhanced capital allowances for investment in plant and machinery and structures and buildings

- Business rates relief

- Employer National Insurance contributions relief

Custom Site Operators

In December 2022, HMRC approved SSO International Freight Forwarding as the freeport’s first Customs Site Operator meaning the LCR Freeport was officially operational.

There are a range of proposed customs zones to be located within the LCR Freeport, across a number of industries that may benefit, from advanced and biomanufacturing, to logistics and ports. These sites will undergo an approval process with Government/HMRC as part of the development of the outline business case.

- Access to duty suspension, duty exemption on re-exports and flexibility on how duty is calculated through duty inversion.

- Allows storage and processing activities in a freeport customs site under one combined Freeport customs special procedure, instead of multiple authorisations.

- Allows storage and processing activities in a freeport customs site under one combined Freeport customs special procedure, instead of multiple authorisations.

- Streamlining the processes for bringing goods into freeport customs sites, as well as between customs sites, and re-export.

- Allowing the movement of goods by conduct between other UK customs sites and into other special procedures to fit the needs of business.

In December 2022, HMRC approved SSO International Freight Forwarding as the freeport’s first Customs Site Operator meaning the LCR Freeport was officially operational.